The Ultimate Guide to Embedded Accounting APIs: Use Cases, Features, and Integrations

What exactly does an embedded accounting API do, and why does it matter?

It lets any SaaS platform turn raw financial data into real-time bookkeeping, reporting, and compliance—without ever forcing users to leave the product. By connecting ledgers, payments, payroll, and analytics behind a single REST endpoint, you slash manual work, speed up month-end close, and unlock new revenue opportunities.

Why Read This Guide

- Exploding Demand: Embedding finance capabilities is now a core buying criterion for B2B SaaS, with APIs outpacing on-prem integrations in adoption (Merge.dev).

- Automation Wins: AI-driven accounting eliminates “manual data entry errors that create reconciliation nightmares” and accelerates close cycles (Numeric).

- Competitive Moat: Offering built-in bookkeeping boosts platform stickiness and unlocks premium pricing tiers.

- Regulatory Pressure: Real-time audit trails and compliance reporting are non-negotiable as ESG, tax, and revenue-recognition laws tighten.

- Developer Speed: Unified APIs mean you can ship sophisticated finance workflows in weeks instead of quarters—if you choose the right partner.

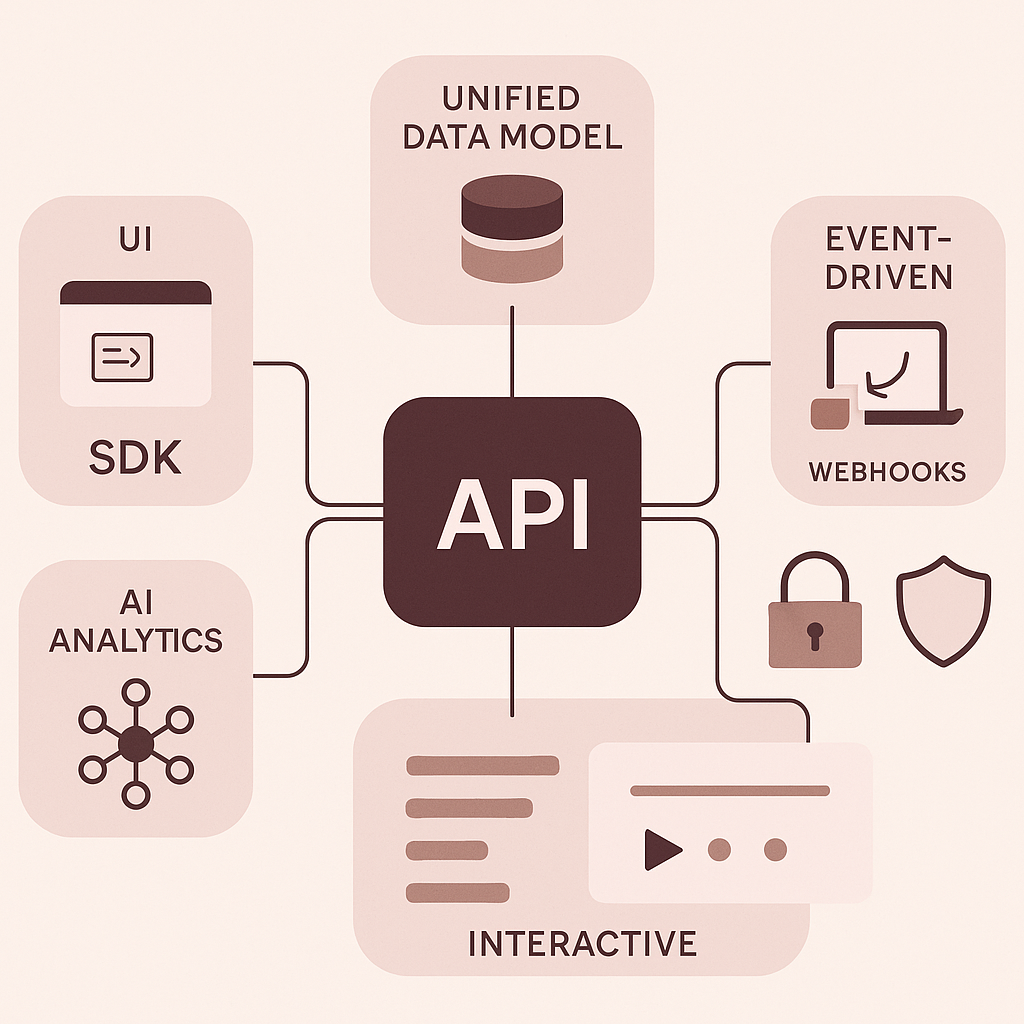

How Embedded Accounting APIs Work

Unified Data Model

- Abstracts GL accounts, transactions, contacts, and invoices into normalized objects.

- Handles multi-entity, multi-currency complexities that “scale processes consistently across different entities, currencies, or business units” (Numeric).

Event-Driven Architecture

- Webhooks broadcast updates in milliseconds—crucial for real-time dashboards and anomaly detection.

- Supports idempotent writes and rollbacks to maintain ledger immutability.

AI Layer

- Modern platforms pair LLMs with rules engines for classification, so “OCR-based capture and smart transaction categorization” happen automatically (Numeric).

- Predictive analytics flag exceptions long before month-end.

Security & Compliance

- SOC 2 Type II, ISO 27001, and audit-ready data lineage.

- Fine-grained OAuth scopes prevent over-permissioning.

Developer Experience

- SDKs in major languages, auto-generated Postman collections, and interactive sandboxes—critical since “integrating with each system presents unique challenges” (Merge.dev).

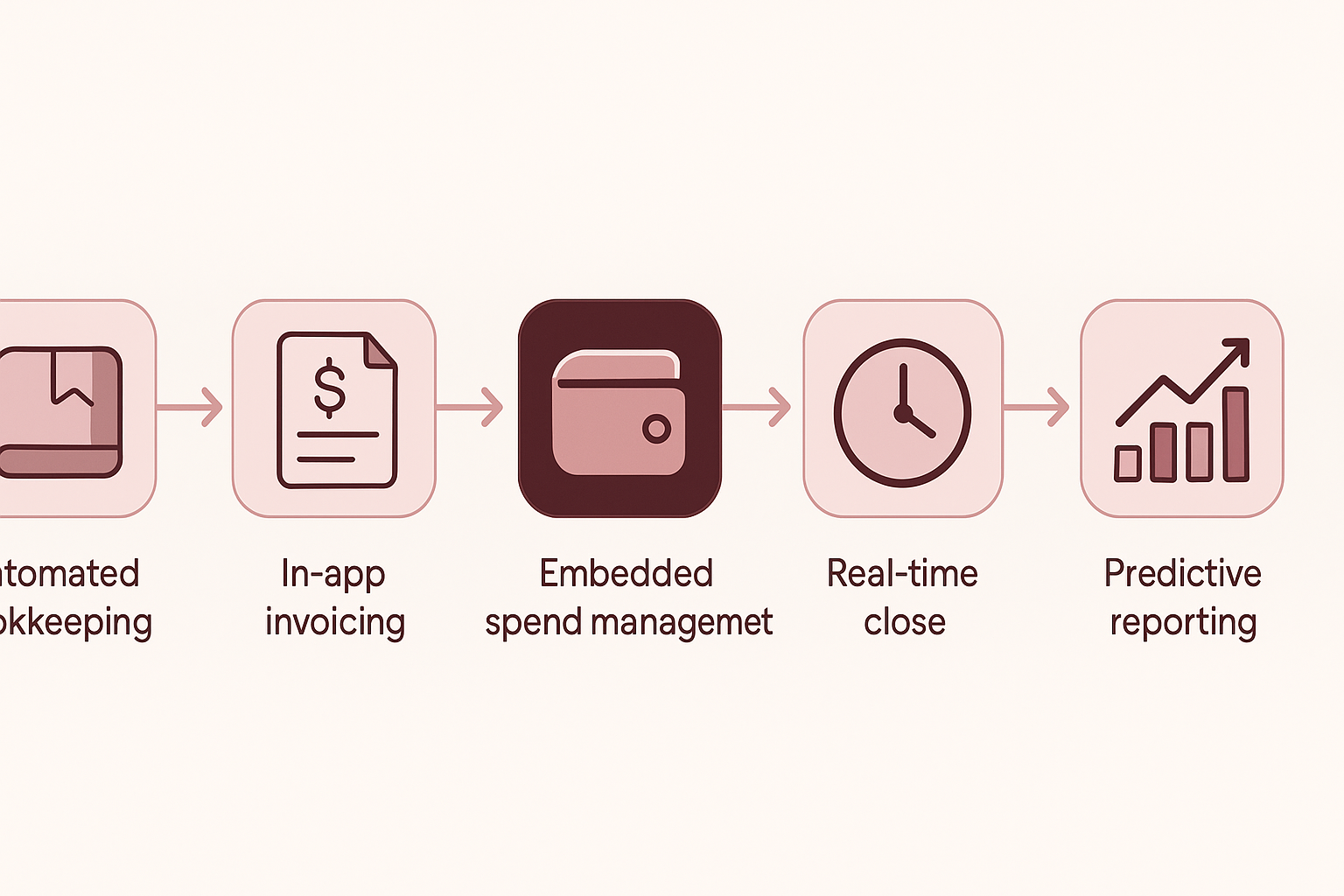

Core Use Cases Across the Customer Journey

| Use Case | API Objects Involved | Business Impact |

|---|---|---|

| Automated Bookkeeping | Transactions, Categories, Attachments | Removes >90 % manual data entry, reducing errors and staff costs (Numeric). |

| In-App Invoicing & AR | Invoices, Contacts, Payments | Turns a SaaS UI into a billing hub; speeds cash collection. |

| Embedded Spend Management | Cards, Vendors, Receipts | Pairs with card issuers like Ramp—whose free API lowers entry cost (Tipalti). |

| Real-Time Close | Journal Entries, Tasks, Tags | “Accelerating month-end close cycles” by auto-reconciling accounts (Numeric). |

| Predictive Reporting | Budgets, Forecasts | Surfaces KPI alerts before they impact runway. |

Key takeaway: A single embedded API can power pre-sale insights, onboarding efficiency, and long-term retention by living where users already work.

Must-Have Features & Security Standards

| Feature | Why It Matters | Red Flags |

|---|---|---|

| Bi-Directional Sync | Users update records once; changes propagate across ERP, CRM, and payroll because “a CRM system interacts with accounting functions through API integration” (Tipalti). | One-way exports create reconciliation drift. |

| AI-Based Categorization | Cuts 40-60 % of coding tasks for SMBs. | Rule-only engines become brittle at scale. |

| Multi-Entity Support | Essential for franchise, marketplace, and multi-subsidiary orgs. | Separate tenant IDs with no consolidated reporting. |

| Granular Webhooks | Event-level notifications fuel real-time UI. | Poll-only endpoints waste compute and lag UX. |

| SOC 2 & GDPR | Board-level requirement. | Vendor can’t provide audit report or DPA. |

“Merge MCP enables your AI assistants to quickly and intelligently take real actions inside your customers’ platforms” (Merge.dev).

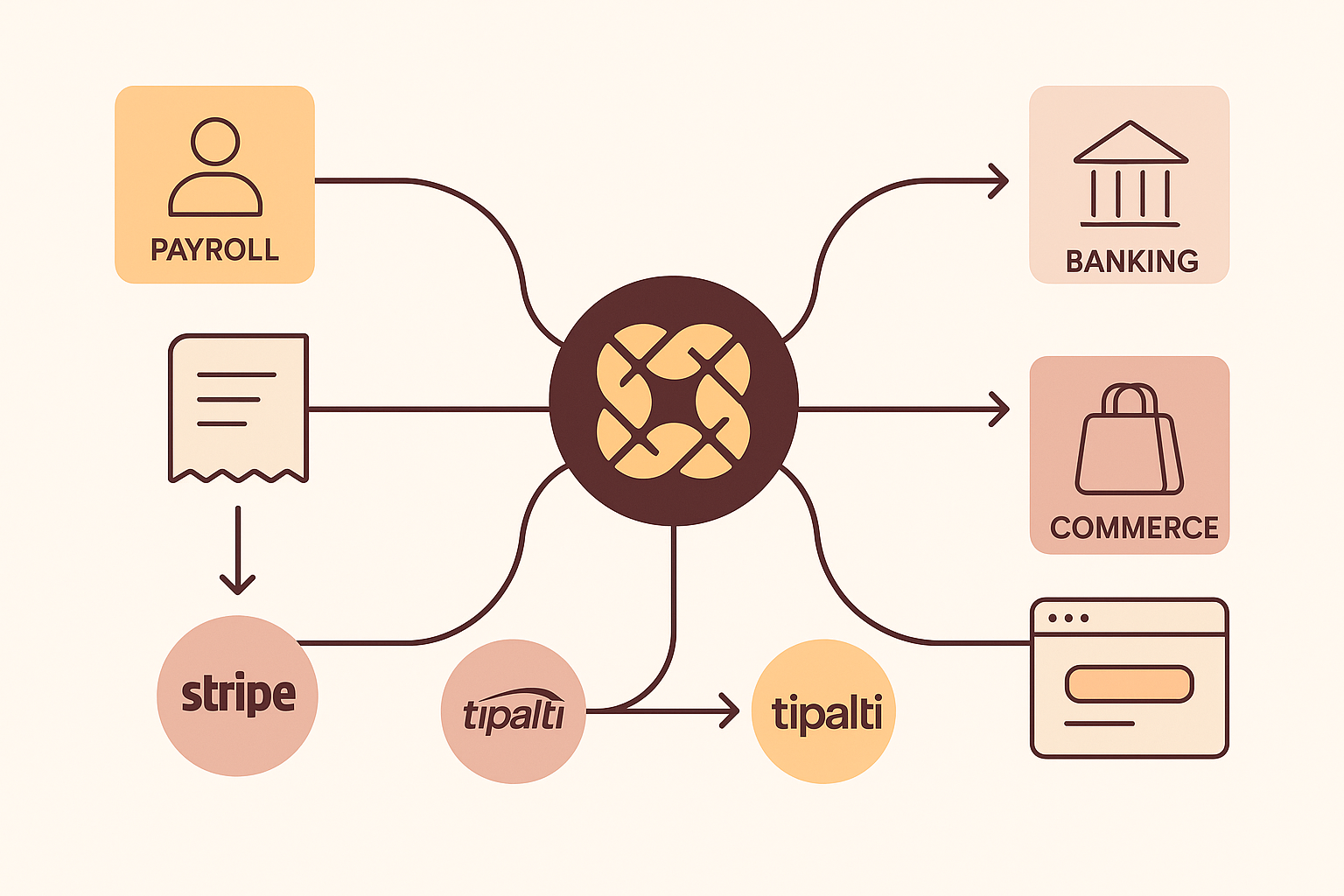

Integration Patterns with Payroll, Banking & Commerce Systems

Payments & Payouts

- Connect processors (Stripe, Tipalti) so AP runs without CSV uploads.

- “For API accounting, your business can connect to a payment processor” (Tipalti).

Payroll & HRIS

- Sync wage expenses, taxes, and benefits to the GL; classify by department automatically.

- AI can auto-allocate multi-department pay based on scheduling data.

Banking Feeds

- Direct‐feed APIs pull cleared transactions hourly—no OFX files.

- Enrich with merchant info for higher categorization accuracy.

eCommerce & Subscription Platforms

- Map orders, refunds, and chargebacks directly to revenue accounts.

- Supports ASC 606 schedules and deferred revenue, vital as regulators tighten recognition rules.

CRM & CPQ

- When a deal closes, automatically push customer records and first invoice.

- Avoids swivel-chair data entry and ensures downstream reports align with sales reality.

Pro Tip: Use a unified API wrapper to abstract SOAP vs. REST differences since “accounting APIs are different in various ways” (Merge.dev).

Build vs. Buy: Tool Comparison

| Platform | Strengths | Pricing (Starter) | Ideal For |

|---|---|---|---|

| Open Ledger | AI-powered bookkeeping, reconciliation, white-label UI, usage-based pricing, launch in weeks. | Usage-based + tiered plans | SaaS platforms embedding full accounting suites |

| Numeric | Close-management automation; deep reconciliation rules. | “Starting at $30/month/user” (Numeric) | Finance teams modernizing ERPs |

| Tipalti | Global AP & partner payments; MSB license for payouts. | Custom quote | Marketplaces paying vendors globally |

| QuickBooks API | Massive SMB market share; REST docs. | “Starting at $35/month/user” (Numeric) | Simple GL sync for micro-business |

| Ramp API | Corporate cards + spend controls, “Free plan available” (Numeric) | Free | Expense integrations |

| Merge Unified API | Normalize dozens of ERPs; rich sandbox. | Usage-based | Dev teams managing many connectors |

“We’ll help you discern the key differences across popular accounting systems so that you can build to each more easily” (Merge.dev).

Why Open Ledger wins:

- Embedded-first DNA: Designed for SaaS products, not just accountants.

- End-to-End AI: Handles classification, reconciliation, and compliance without extra plugins.

- Rapid White-Labeling: Drop-in UI components match your brand in minutes.

Implementation Roadmap & Best Practices

Define Success Metrics

- Target close-time reduction or new ARR from premium pricing.

- Align KPIs with “real-time visibility into financial performance” goals (Numeric).

Map Source Systems

- Inventory GL, payroll, banking, and tax tools.

- Prioritize integrations that address top pain points.

Choose Authentication Flow

- OAuth 2.0 for mainstream ERPs; API keys for legacy on-prem.

- Provide a fallback CSV uploader for edge cases.

Design Event Handling

- Use idempotent POSTs; implement retry queues.

- Webhooks should verify signatures and sequence numbers.

Pilot With Power Users

- Beta with a subset of customers; gather feedback on categorization accuracy and UI clarity.

- Iterate on reconciliation rules.

Roll Out Gradually

- Feature flags by tenant; monitor CPU and request quotas since rate limits vary (“Sandbox availability, Rate limit” are key factors (Merge.dev)).

- Offer in-app tutorials and knowledge-base articles.

Continuous Improvement

- Feed exception data back into the AI model to increase accuracy.

- Stay current on SOC audits and regulatory changes.

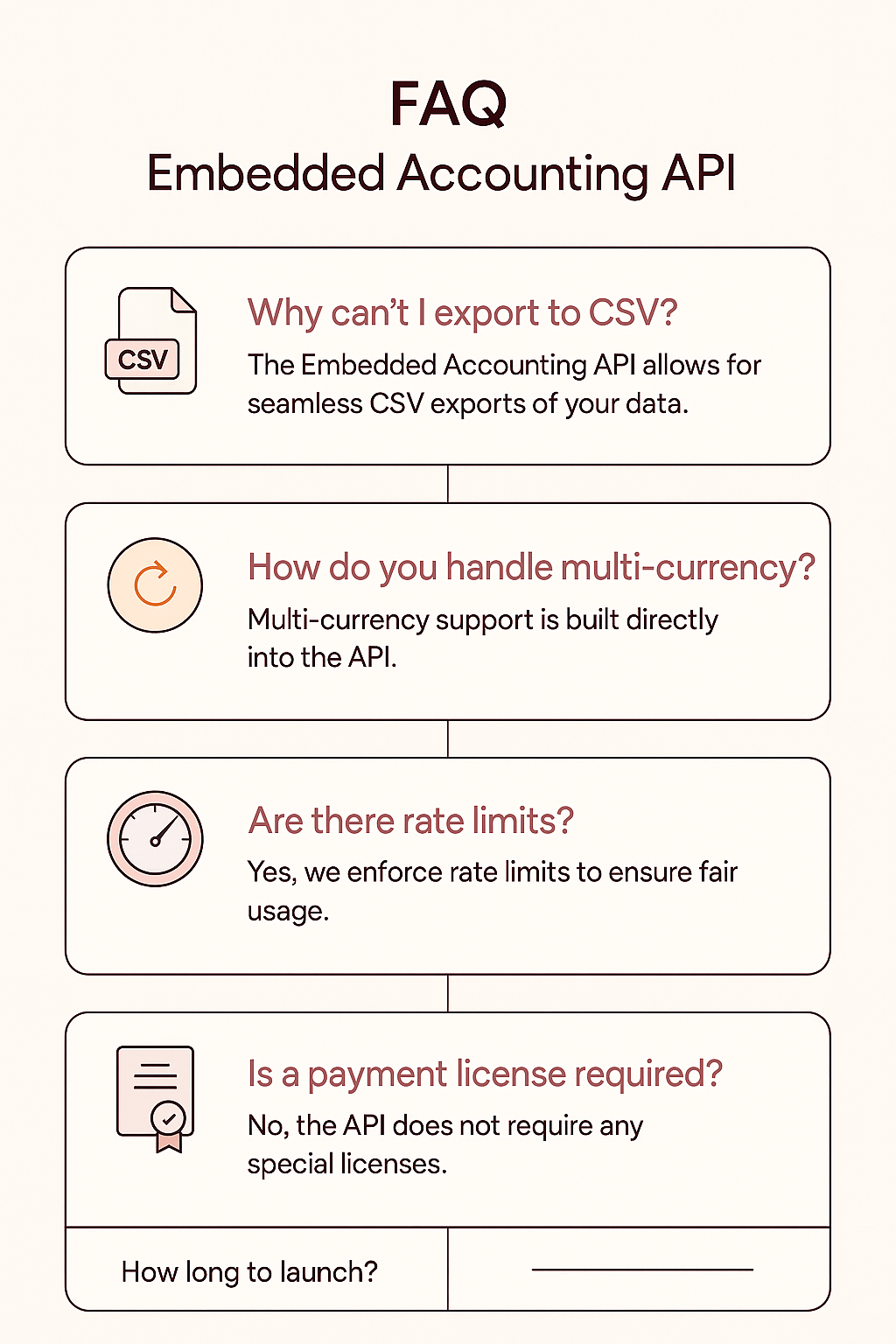

Frequently Asked Questions

Isn’t it easier to just export CSVs into an ERP?

Manual exports create spooky “reconciliation nightmares” later on (Numeric). APIs give deterministic sync and audit trails.

Can an embedded API handle multi-currency?

Yes—look for platforms that “scale processes consistently across different currencies” (Numeric).

What about rate limits?

Vendor policies vary widely, so use back-off logic. Merge’s guide lists limit details for the top seven APIs (Merge.dev).

Do I need a payments license?

If you’re moving money, partner with a provider like Tipalti, “a money services business” (Tipalti), or choose an API that abstracts payouts.

How soon can I launch?

Teams using Open Ledger’s white-label components typically go live in under six weeks—versus six months for a ground-up build.

Conclusion

Embedded accounting APIs are now table stakes for SaaS platforms that want to own the full financial workflow—from transaction ingest to AI-driven reporting. Choosing a unified, AI-powered solution saves months of engineering effort, unlocks new monetization levers, and keeps customers loyal through seamless user experiences. Ready to turn bookkeeping and compliance into your product’s next revenue stream? Talk to Open Ledger today and launch embedded accounting in weeks, not quarters.

Citations

- https://mcxnxesjearjdhyqqgxy.supabase.co/storage/v1/object/public/concierge-blog-images/1b880274-7a03-4957-b7dc-438ba6ec26f4/65c638cf-020b-45a5-a40b-b5715fe125c8/generated_image_65c638cf-020b-45a5-a40b-b5715fe125c8_0_6534a789.png?

- https://mcxnxesjearjdhyqqgxy.supabase.co/storage/v1/object/public/concierge-blog-images/1b880274-7a03-4957-b7dc-438ba6ec26f4/65c638cf-020b-45a5-a40b-b5715fe125c8/generated_image_65c638cf-020b-45a5-a40b-b5715fe125c8_1_d3537d8d.png?

- https://mcxnxesjearjdhyqqgxy.supabase.co/storage/v1/object/public/concierge-blog-images/1b880274-7a03-4957-b7dc-438ba6ec26f4/65c638cf-020b-45a5-a40b-b5715fe125c8/generated_image_65c638cf-020b-45a5-a40b-b5715fe125c8_2_cb539f6b.png?

- https://mcxnxesjearjdhyqqgxy.supabase.co/storage/v1/object/public/concierge-blog-images/1b880274-7a03-4957-b7dc-438ba6ec26f4/65c638cf-020b-45a5-a40b-b5715fe125c8/generated_image_65c638cf-020b-45a5-a40b-b5715fe125c8_3_75b18c10.png?

- https://mcxnxesjearjdhyqqgxy.supabase.co/storage/v1/object/public/concierge-blog-images/1b880274-7a03-4957-b7dc-438ba6ec26f4/65c638cf-020b-45a5-a40b-b5715fe125c8/generated_image_65c638cf-020b-45a5-a40b-b5715fe125c8_4_1cb9acf8.png?

- https://tipalti.com/blog/accounting-api/

- https://www.merge.dev/blog/accounting-api

- https://www.numeric.io/blog/ai-accounting-software

Get started with Open Ledger now.

Discover how Open Ledger’s embedded accounting API transforms your SaaS platform into a complete financial hub.