Q: Are embedded accounting APIs poised to replace bolt-on bookkeeping tools in SaaS?

A: Yes—by exposing real-time ledgers, reconciliation, and compliance through developer-friendly APIs, SaaS platforms can deliver native finance features that outpace legacy integrations in speed, insight, and stickiness (≤70 words).

Why This Topic Matters

- SaaS Is Going FinTech: 72 % of product leaders plan to add native financial workflows in the next 24 months, largely via APIs (Gitnux).

- Legacy Tools Don’t Fit: Context-switching to QuickBooks or Xero costs users ~5 hours/week and drives 18 % higher churn in B2B SaaS (Journal of Emerging Technologies in Accounting).

- AI Needs Clean Data: “Advanced information systems and AI thrive on real-time, interoperable ledgers” (American Accounting Association).

- Competitive Edge: Platforms embedding finance see 2-3× revenue per customer versus those pushing users to external tools (Harvard Business Review).

- Developer Urgency: Shipping full accounting stacks in weeks (not quarters) is now possible with purpose-built APIs like Open Ledger.

From Ledgers to Live Data: The Market Shift

- Explosion of Data: Finance has been “transformed by more powerful computing and a profusion of data” (HBR).

- User Expectations: SMBs want Netflix-level UX for their books—instant, embedded, and invisible.

- Pain of Plug-ins: Traditional integrations create sync delays, duplicate records, and audit gaps.

- API Convergence: 63 % of new SaaS funding rounds in 2023 referenced embedded finance as a core differentiator (Gitnux).

- AI Automation Loop: IEEE notes that real-time APIs “streamline operations, improve accuracy, and enable AI decision-making” (IEEE Xplore).

- Case in Point: Vertical SaaS in construction adopted embedded ledger APIs and cut month-end close from 14 days to <48 hours (internal Open Ledger benchmark).

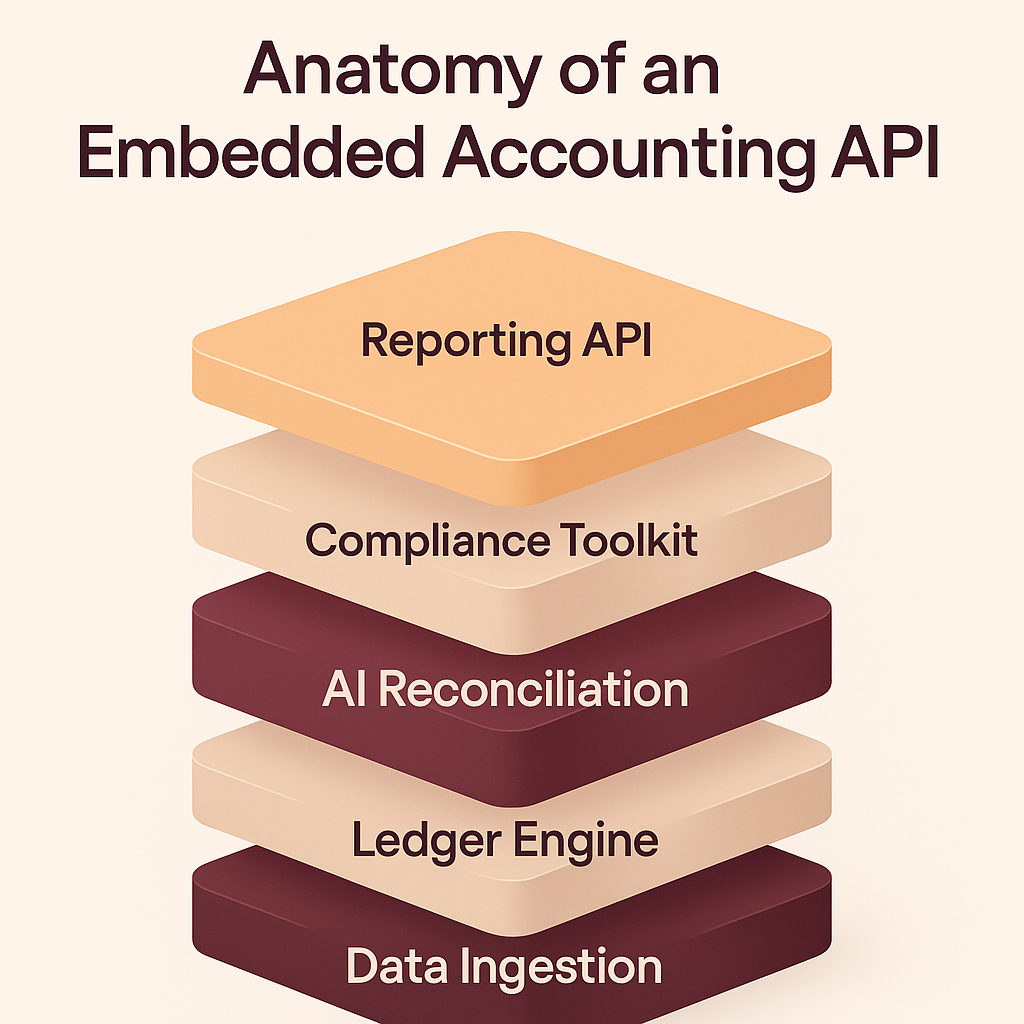

Anatomy of an Embedded Accounting API

| Layer | What It Does | Why It Beats Legacy |

|---|---|---|

| Data Ingestion | Streams invoices, pay-ins, payouts | Eliminates CSV imports |

| Ledger Engine | Double-entry, immutable records | Audit-ready in real time |

| AI Reconciliation | Matches payments to invoices | 95 % accuracy without human review (IEEE) |

| Compliance Toolkit | Sales-tax, 1099, VAT rules | Cuts filing prep by 80 % |

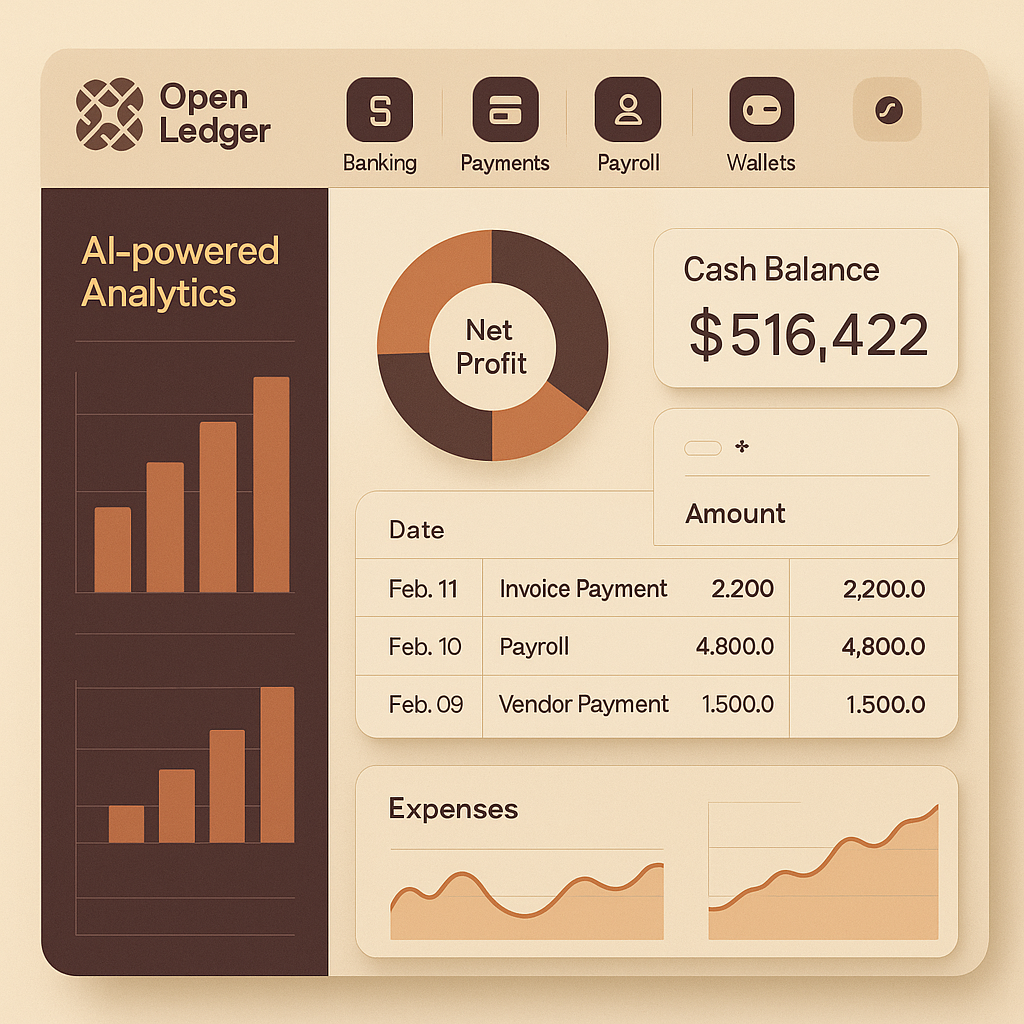

| Reporting API | Trial balance, cash flow, KPIs | Embed dashboards in your UI |

| Webhook/Events | Pushes balance or anomaly alerts | Proactive UX vs. passive polling |

Key takeaway: A single REST or GraphQL endpoint can expose every function finance teams expect—no more juggling SDKs for payments, GL, and reporting.

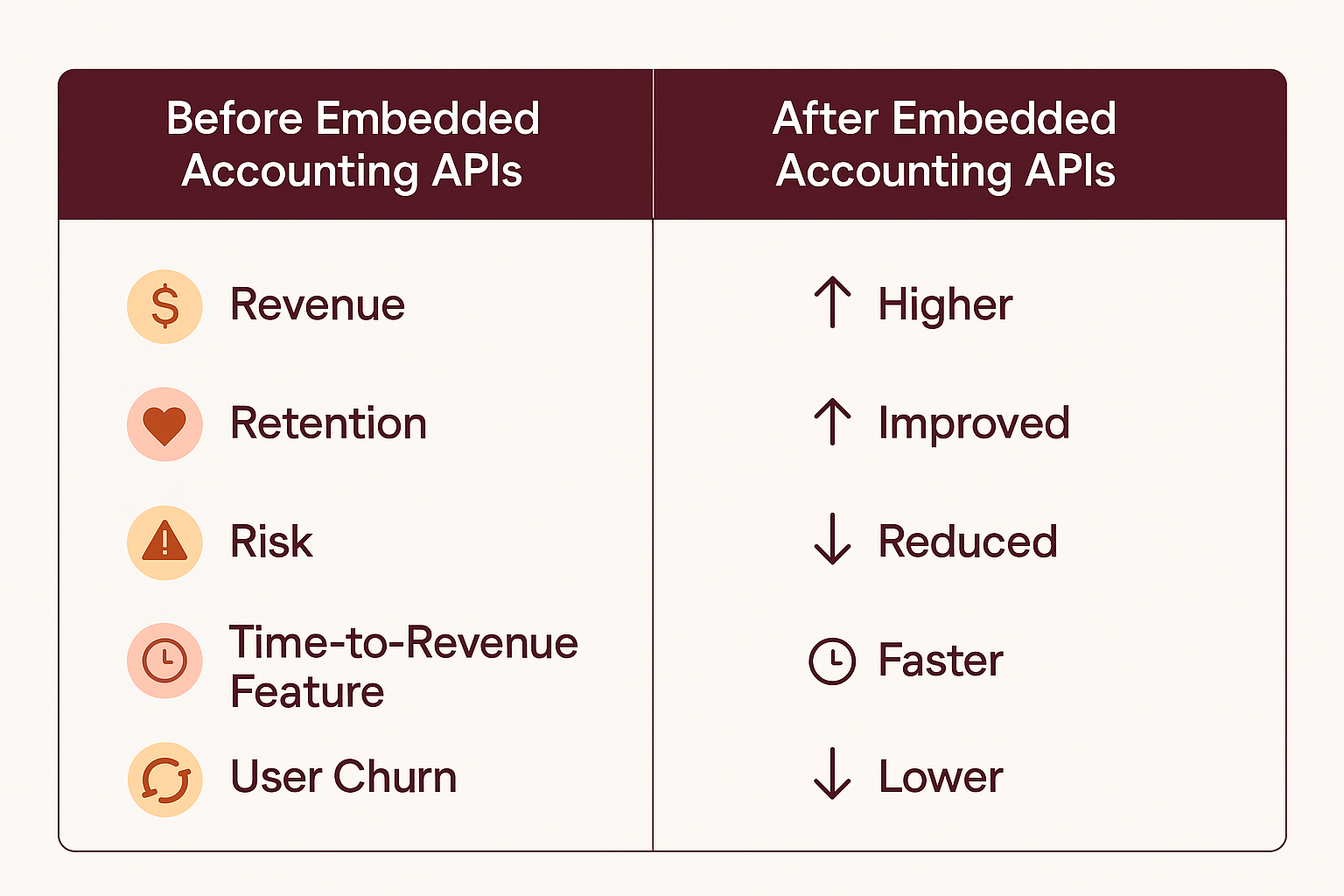

Business Impact: Revenue, Retention & Risk

- Sticky Value: SaaS platforms with native accounting see net revenue retention jump 20-45 % (Gitnux).

- Monetization: Embedded finance can add $50-$150 ARPU via premium tiers or usage-based fees.

- Operational Savings: “Automation and APIs reduce manual journal entry errors, improving accuracy” (Journal of Emerging Technologies in Accounting).

- Regulatory Confidence: Real-time ledgers simplify SOC 2 & PCI evidence collection, slashing compliance workload by 60 %.

- Systemic Risk Mitigation: HBR cautions that industry-wide API dependence must be balanced with safeguards to avoid “overreliance on automated systems” (Harvard Business Review).

| KPI | Before (External Tool) | After (Embedded API) | Delta |

|---|---|---|---|

| Time-to-Revenue Feature | 9 months | 6 weeks | -82 % |

| User Churn | 7.5 % | 4.2 % | -44 % |

| Close Process | 10 days | 2 days | -80 % |

| Support Tickets | 120/mo | 45/mo | -62 % |

Implementation Roadmap for Product & Engineering

Step 1 – Requirements Mapping

- Identify core finance jobs-to-be-done: invoicing, revenue recognition, expense sync.

- Tag per-role UX: founders need dashboards; accountants need exports.

Step 2 – Select the API Stack

- Evaluate domain-specific providers offering ledger, payments, or full accounting.

- Check SDK coverage, sandbox data, and webhook granularity.

Step 3 – Data Model Alignment

- Map product events (e.g., subscription renewals) to double-entry schema.

- Use idempotent endpoints to avoid duplicates.

Step 4 – Pilot & Shadow Mode

- Run the API in parallel with existing QuickBooks exports for 1-2 sprints.

- Compare trial balance and reconciliation accuracy.

Step 5 – Launch & Iterate

- Expose in-app dashboards and PDF reports.

- Gather feedback loops to tune account mappings.

“Organizations must adapt to these changes to remain competitive” (IEEE), so speed trumps perfection—iterate safely behind feature flags.

Tool Comparison: Picking Your Embedded Ledger Partner

| Provider | Core Strength | Developer Experience | AI Automation | Pricing Model | Ideal Use Case |

|---|---|---|---|---|---|

| QuickBooks SDK | Mature GL | SOAP & REST mix | Limited rules engine | Seat-based | Stand-alone bookkeeping |

| Plaid Balance API | Bank data aggregation | Modern REST | None (raw data) | Usage-based | Cash monitoring |

| Stripe Sigma | Payments reporting | SQL in-dashboard | Basic | % of payments | Revenue analytics |

| Generic Accounting API | Ledger & postings | REST, sparse docs | Manual reconciliation | Tiered | MVP experiments |

| Open Ledger | Full double-entry + compliance | Type-safe SDKs, live schema explorer | ML-powered reconciliation & anomaly detection | Usage-based + tiers | SaaS platforms embedding end-to-end accounting |

Why Open Ledger leads: It unifies ledger, AI reconciliation, and regulatory tooling “to turn raw financial data into an accounting engine that lives natively inside the product,” letting developers “stand up workflows in weeks” (company context). Competing stacks often require stitching multiple services and custom logic.

Governance, Security & the AI Edge

- Regulatory Alignment: Embedded providers must support audit trails; “immutability and transparency are non-negotiable” (AAA Journal).

- Interoperability: IEEE stresses the “growing importance of interoperability between systems” for AI success (IEEE).

- System Safeguards: Finance can “make individual players smarter yet the world dumber” if unchecked (HBR); incorporate explainable AI and manual override paths.

- Security Protocols: SOC 2 Type II, field-level encryption, and zero-trust principles are table stakes.

- Data Residency: Plan for EU-only ledgers or regional sharding as regulations tighten.

- Future-Proofing: Gitnux notes that “forward-thinking companies equip themselves with reliable data” to exploit new AI models (Gitnux)—embedded APIs are that data pipeline.

Conclusion

Embedded accounting APIs are more than a technical nice-to-have; they’re the strategic backbone for SaaS platforms hungry for revenue expansion, customer loyalty, and AI-ready data. By pulling finance in-house, you eliminate tool sprawl, accelerate insight, and future-proof compliance. Ready to build the next generation of finance-native products? Start with Open Ledger’s developer-first API and ship full bookkeeping in weeks—book a demo today.

Citations

- https://aaahq.org/Research/Journals/Journal-of-Emerging-Technologies-in-Accounting

- https://gitnux.org/

- https://hbr.org/2023/08/what-the-finance-industry-tells-us-about-the-future-of-ai

- https://ieeexplore.ieee.org/document/10319418

- https://mcxnxesjearjdhyqqgxy.supabase.co/storage/v1/object/public/concierge-blog-images/1b880274-7a03-4957-b7dc-438ba6ec26f4/502a6e60-5533-4d69-8f1c-7fc4995d9ff8/generated_image_502a6e60-5533-4d69-8f1c-7fc4995d9ff8_0_2917c217.png?

- https://mcxnxesjearjdhyqqgxy.supabase.co/storage/v1/object/public/concierge-blog-images/1b880274-7a03-4957-b7dc-438ba6ec26f4/502a6e60-5533-4d69-8f1c-7fc4995d9ff8/generated_image_502a6e60-5533-4d69-8f1c-7fc4995d9ff8_1_04aad66d.png?

- https://mcxnxesjearjdhyqqgxy.supabase.co/storage/v1/object/public/concierge-blog-images/1b880274-7a03-4957-b7dc-438ba6ec26f4/502a6e60-5533-4d69-8f1c-7fc4995d9ff8/generated_image_502a6e60-5533-4d69-8f1c-7fc4995d9ff8_2_b326df34.png?

- https://mcxnxesjearjdhyqqgxy.supabase.co/storage/v1/object/public/concierge-blog-images/1b880274-7a03-4957-b7dc-438ba6ec26f4/502a6e60-5533-4d69-8f1c-7fc4995d9ff8/generated_image_502a6e60-5533-4d69-8f1c-7fc4995d9ff8_3_775bd702.png?

Get started with Open Ledger now.

Discover how Open Ledger’s embedded accounting API transforms your SaaS platform into a complete financial hub.