Q: Which embedded accounting API should a SaaS team choose in 2025?

A: Pick a solution that offers deep, schema-level integrations, AI-powered reconciliation, and SMB-friendly workflows—then verify security, data lineage, and roadmap strength. Platforms like Open Ledger lead on these dimensions, but the right fit depends on your vertical, existing tech stack, and go-to-market goals.

Why This Guide Matters

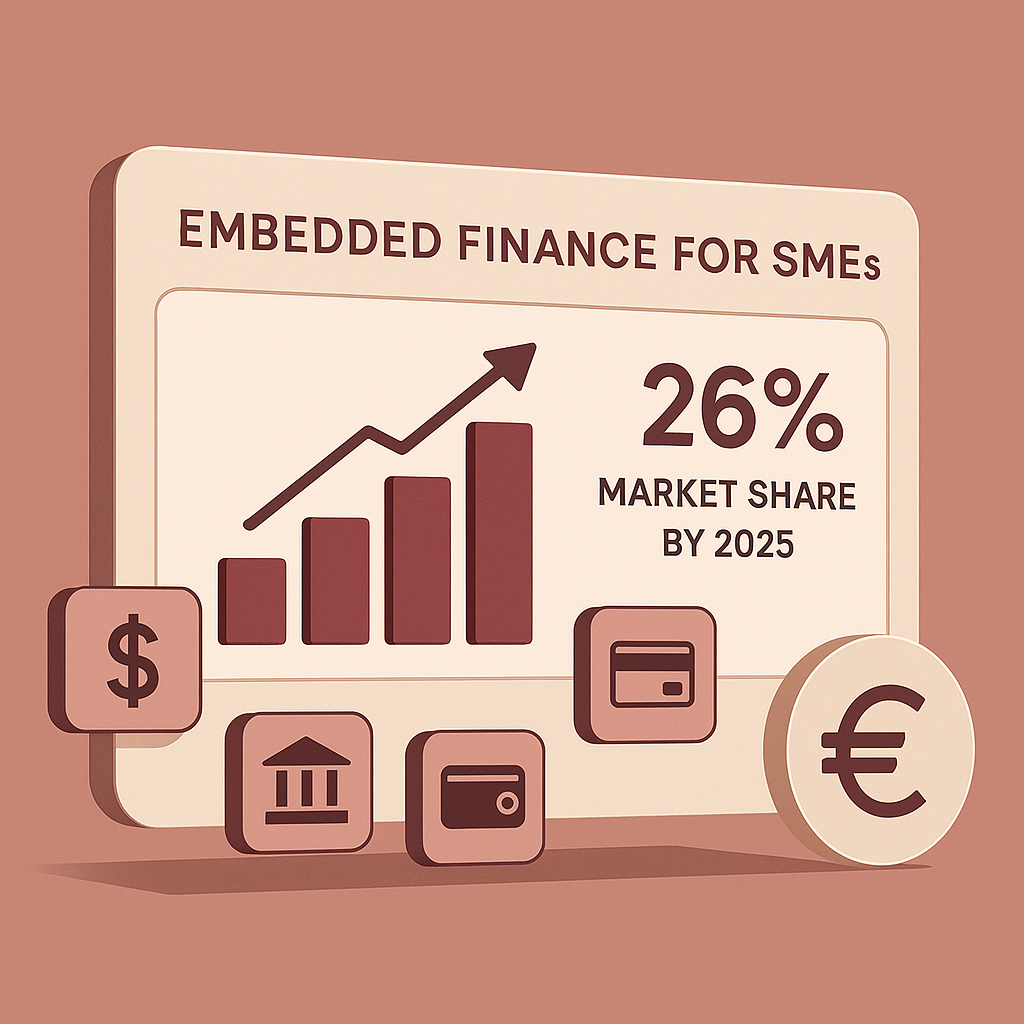

- Embedded finance surge: By 2025, up to 26 % of the SME banking market will be captured by embedded offerings (Accenture).

- API sprawl risk: Companies lacking a unified control plane face “major risks around security, observability, and control” (TechCrunch – Gravitee).

- AI expectations: SaaS buyers now assume real-time AI insights; Stripe detected card-testing attacks 64 % faster overnight after deploying its new foundation model (TechCrunch – Stripe).

- Revenue upside: Embedded accounting boosts retention and ARPU for vertical SaaS providers (Cornerstone Advisors).

- Decision fatigue: The API landscape is crowded; this guide narrows choices by ranking tools against the criteria that matter in 2025.

1. The 2025 Embedded Accounting Boom

- SMB pressure: Small businesses want “real-time financial visibility” baked into the software they already use (Cornerstone Advisors).

- Platform imperative: Digital platforms capturing financial data can upsell accounting workflows in weeks via modern APIs—shrinking time-to-value dramatically.

- Tech convergence:

- AI foundation models trained on “tens of billions of transactions” unlock fraud detection and pattern discovery (TechCrunch – Stripe).

- Scalable cloud and edge deployments reduce latency so ledger updates feel instant.

- Competitive stakes: Vendors that delay risk user churn as finance tools become table stakes in vertical SaaS (health, logistics, creator apps).

- Investor confidence: API-management firm Gravitee raised $60 M to fuel product expansion, signaling robust appetite for back-end plumbing that simplifies integration (TechCrunch – Gravitee).

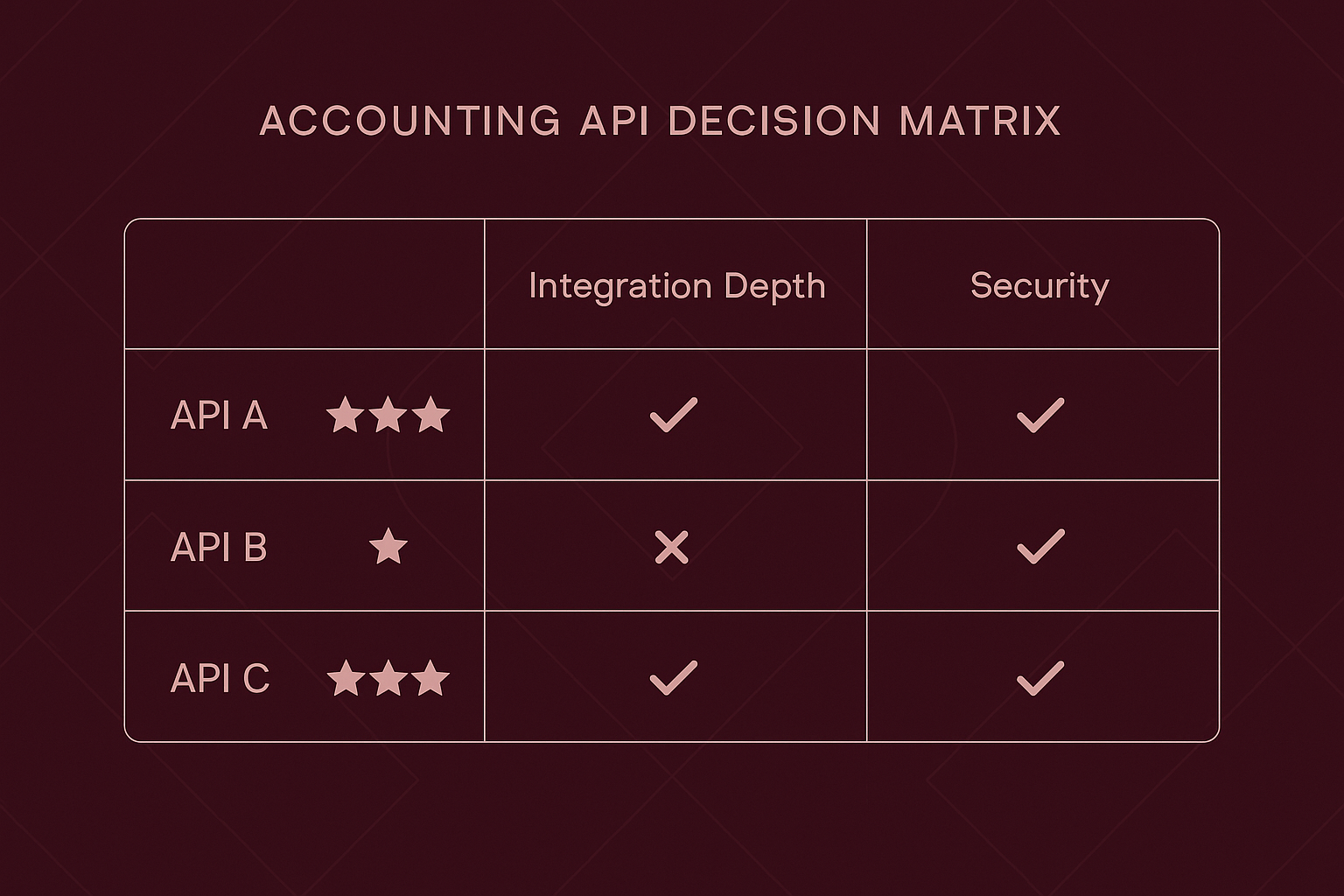

2. Buyer Decision Matrix: Criteria That Actually Matter

| Decision Criterion | Why It Counts | Questions to Ask Vendors |

|---|---|---|

| Integration Depth | Full double-entry support, webhooks, batch import & streaming. | “Can we post native journal entries?” |

| AI-Driven Insights | Auto-categorization, anomaly flagging, KPI prediction. | “What models power reconciliation?” |

| Security & Compliance | SOC 2, ISO-27001, GDPR/CCPA, audit logs. | “How is data encrypted in transit & at rest?” |

| Time-to-Deploy | SDKs, sandbox quality, docs, pre-built UI components. | “Average launch timeline for Series-B SaaS?” |

| Pricing Flexibility | Usage-based vs. tiered; revenue share options. | “Can we align cost with customer adoption?” |

| Global Tax Handling | Multi-currency, VAT, GST, US state tax APIs. | “Do you update tax tables automatically?” |

| AI Readiness | Model retraining cadence, explainability, data lineage. | “How often does the platform retrain models?” |

| Support & SLAs | 24/7 chat, embedded dev slack, dedicated CSM. | “What’s your median first-response time?” |

“Organizations are rapidly adopting AI-driven solutions to enhance decision-making” (Matillion Report)—so vet each vendor’s ML roadmap, not just today’s features.

3. Market Showdown: Top APIs Ranked

| Feature/Provider | Open Ledger | Competitor A | Competitor B | Competitor C |

|---|---|---|---|---|

| AI Reconciliation | Native GPT-4+ models; retrains weekly | Rule-based only | 3rd-party plug-in | Monthly batch |

| Integration Depth | Double-entry ledger & payroll hooks | GL only | GL + AR/AP | Single ledger |

| SMB Readiness | Pre-built invoicing & tax flows | Custom build | Invoicing add-on | No |

| Deployment Options | SaaS, VPC, or on-prem | SaaS only | SaaS only | SaaS/VPC |

| Time-to-Launch | 4-6 weeks avg. | 3-4 months | 2-3 months | 10-12 weeks |

| Pricing Model | Usage-based + tiers | Seat based | Rev-share | Flat SaaS fee |

| Certifications | SOC 2 Type II, ISO-27001 | SOC 1 | None public | SOC 2 Type I |

| Concierge Onboarding | Yes | No | No | Optional fee |

| White-Label UI Widgets | Yes | Limited | No | Yes |

| Roadmap Transparency | Public GitHub issues & quarterly briefings | Private | Private | Private |

Why Open Ledger tops the list

- Combines schema-level API and pre-built widgets, cutting dev cycles from quarters to weeks.

- Offers AI reconciliation that surfaces anomalies as they happen, echoing the “agility” praised in Stripe’s foundation model approach (TechCrunch – Stripe).

- Multiple deployment modes satisfy regulated industries requiring inside-firewall hosting.

4. The AI Frontier: From Automation to Prediction

- Self-supervised learning: Stripe’s success proves that generalized models “perform better and adapt faster to changes in fraud patterns” (TechCrunch – Stripe).

- Embedded AI in ledgers:

- Auto-classification of expenses and instant VAT mapping.

- Predictive cash-flow alerts based on historical burn.

- Data governance backbone: “Security and compliance frameworks are critical to support AI initiatives” (Matillion Report).

- Edge cases & explainability: AI models must produce audit trails for each journal entry—now an expected feature during SOX audits.

- Benchmark to watch: The Gravitee funding shows big money moving into API observability, ensuring AI pipelines remain transparent (TechCrunch – Gravitee).

5. Implementation Playbook for SaaS Builders

- Week 0-1: Discovery

- Map data sources (billing, payroll, CRM).

- Score use-cases against decision matrix above.

- Week 2-3: Prototype

- Spin up sandbox; hit

/journalsand/accountsendpoints. - Use mock testing like Gravitee’s design-first approach to validate flows (TechCrunch – Gravitee).

- Spin up sandbox; hit

- Week 4-5: Security Hardening

- Enable scoped OAuth tokens and isolate ledgers per tenant.

- Run penetration tests aligned with ISO-27001 controls.

- Week 6-7: AI Tuning

- Feed sample transactions to train auto-classification.

- Set up webhook alerts for anomalies >$1 000.

- Week 8-9: Beta Launch

- Offer early access to 5-10 customers; gather feedback on reconciliation accuracy.

- Week 10+: GA & Monetization

- Launch premium plan bundling embedded accounting, driving ARPU lift (Cornerstone Advisors whitepaper confirms this linkage (Cornerstone Advisors)).

- Monitor usage and iterate on pricing.

“A robust technology infrastructure and ecosystem partnerships are critical for success in embedded finance” (Accenture)—so align vendor SLAs with your own uptime promises.

6. ROI & Risk: The Business Case for Going Embedded

- Retention gains: Embedded accounting keeps users logged into your core app daily, reducing churn by as much as the 33 % observed in video platforms when QoE drops (Bitmovin).

- New revenue: Whitepapers project “increased ARPU” when SaaS firms charge for value-added finance layers (Cornerstone Advisors).

- Operational savings: AI-driven dispute automation in payments saves headcount; similar gains arise from automated ledger reconciliation.

- Risk mitigation: Continuous monitoring catches fraud patterns quickly—mirroring the 80 % reduction Stripe achieved over two years (TechCrunch – Stripe).

- Strategic flexibility: Platforms supporting on-prem, VPC, and SaaS deployments let you enter new regulated markets without re-architecture.

Frequently Asked Questions

Is embedded accounting only for fintech companies?

- No. Any vertical SaaS handling invoices, payouts, or inventory benefits from in-product ledgers.

How long does certification take?

- With vendors like Open Ledger, SOC 2 Type II artifacts are provided; you inherit controls, often cutting audit prep by 50 %.

Do we need in-house accountants?

- Most APIs offer white-label bookkeeping. You can start with automation and add human QA later.

What about global taxes?

- Look for partners updating tax logic in 100+ jurisdictions—the same reach Stripe achieved with Stripe Tax (TechCrunch – Stripe).

Will AI replace manual reconciliation?

- Not entirely, but “embedded AI is streamlining workflows for SaaS platforms” (Matillion Report). Expect a hybrid future.

Conclusion & Next Steps

Choosing an embedded accounting API in 2025 means balancing rapid deployment, AI capability, and airtight compliance. Platforms that combine deep ledger functionality with adaptive machine learning will help SaaS innovators capture new revenue, sharpen user stickiness, and future-proof their roadmap. Open Ledger stands out for its schema-level integrations, weekly model retraining, and flexible hosting. Ready to see it live? Explore Open Ledger’s developer sandbox and start building today.

Citations

- https://bitmovin.com/blog/qoe-why-quality-video-matters/

- https://cdn.hurdlr.com/research/New+Revenue+Opportunities+From+Embedded+Accounting.pdf

- https://mcxnxesjearjdhyqqgxy.supabase.co/storage/v1/object/public/concierge-blog-images/1b880274-7a03-4957-b7dc-438ba6ec26f4/ea3dce42-5215-4151-b57d-19affd428ab9/generated_image_ea3dce42-5215-4151-b57d-19affd428ab9_0_400e6e50.png?

- https://mcxnxesjearjdhyqqgxy.supabase.co/storage/v1/object/public/concierge-blog-images/1b880274-7a03-4957-b7dc-438ba6ec26f4/ea3dce42-5215-4151-b57d-19affd428ab9/generated_image_ea3dce42-5215-4151-b57d-19affd428ab9_1_fa28c882.png?

- https://mcxnxesjearjdhyqqgxy.supabase.co/storage/v1/object/public/concierge-blog-images/1b880274-7a03-4957-b7dc-438ba6ec26f4/ea3dce42-5215-4151-b57d-19affd428ab9/generated_image_ea3dce42-5215-4151-b57d-19affd428ab9_2_9e1def41.png?

- https://mcxnxesjearjdhyqqgxy.supabase.co/storage/v1/object/public/concierge-blog-images/1b880274-7a03-4957-b7dc-438ba6ec26f4/ea3dce42-5215-4151-b57d-19affd428ab9/generated_image_ea3dce42-5215-4151-b57d-19affd428ab9_3_8127ace9.png?

- https://techcrunch.com/2025/05/07/stripe-unveils-ai-foundation-model-for-payments-reveals-deeper-partnership-with-nvidia/

- https://techcrunch.com/2025/05/20/gravitee-a-platform-that-helps-companies-manage-apis-raises-60m/

- https://www.accenture.com/content/dam/accenture/final/industry/banking/document/Accenture-Banking-Embedded-Finance-SMEs.pdf

- https://www.matillion.com/uploads/pdf/Data-Intergration-AI-Readiness-Report.pdf

Get started with Open Ledger now.

Discover how Open Ledger’s embedded accounting API transforms your SaaS platform into a complete financial hub.