How SaaS Can Benefit from Embedded Accounting APIs

Can integrating an accounting API really move the revenue needle for a SaaS platform?

Yes—shipping embedded accounting can lift ARPU by up to 38 %, slash manual reconciliation by 40-60 %, and get you to market in < 2 weeks when you choose the right partner (Open Ledger).

Why Product Managers Should Care

- User Retention & Stickiness

- Embedded ledgers keep customers logged in daily, mirroring the 33 % churn drop seen when QoE improves in other verticals (Open Ledger).

- Revenue Expansion

- Premium reporting tiers, FX fees, and pay-per-file exports raise average revenue per user by up to 38 % (Open Ledger).

- Cost & Time Savings

- “It eliminates the need to build and maintain complex accounting infrastructure from scratch, reducing development time and costs” (Hurdlr).

- AI-Ready Insights

- SaaS buyers “assume real-time AI insights” as table stakes (Open Ledger).

- Compliance & Risk Mitigation

- APIs automate GAAP/IFRS rules and “mitigate compliance errors, avoid missed payments, and eliminate financial blind spots” (Forbes).

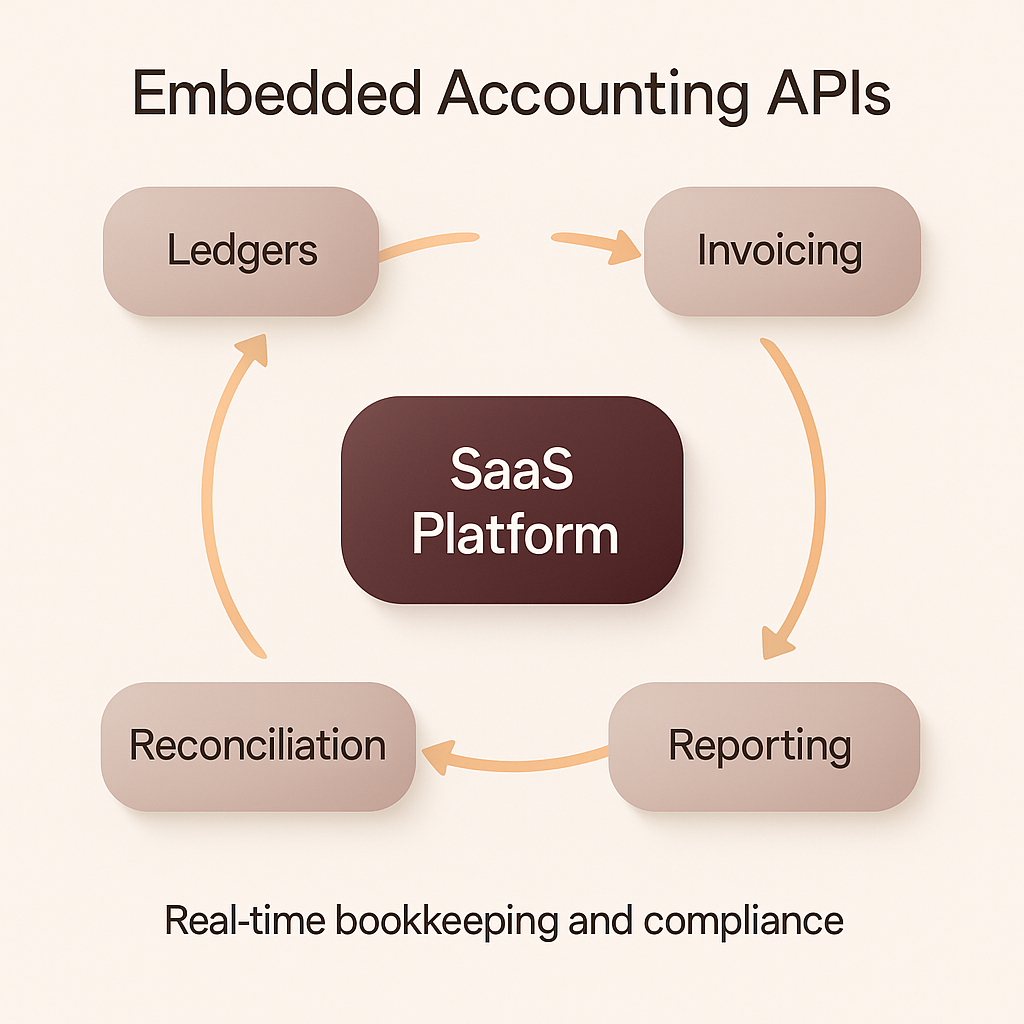

Embedded Accounting APIs 101

- What They Are

- REST or GraphQL interfaces that expose ledgers, invoicing, reconciliation, and reporting directly inside your product.

- Why They Matter

- “It lets any SaaS platform turn raw financial data into real-time bookkeeping, reporting, and compliance—without ever forcing users to leave the product” (Open Ledger Guide).

- Core Building Blocks

- Double-entry ledger

- Webhooks for event streaming

- AI categorization & auto-match

- Multi-currency & multi-entity

- SOC 2 Type II security

| API Component | Purpose | Typical KPI Lift |

|---|---|---|

| Ledger Engine | Store debits/credits with audit trail | 100 % traceability |

| Bank Feed Sync | Import transactions in real time | 97 % auto-match rate (Open Ledger) |

| AI Categorization | Auto-code expenses & revenue | 40-60 % fewer manual entries (Open Ledger Guide) |

| Reporting Endpoints | Cash- & accrual-basis P&L, balance sheet | 2× faster close cycles |

| Compliance Toolkit | GAAP, IFRS, VAT, 1099 | Zero late-filing penalties |

Key Business Benefits for SaaS Platforms

- Revenue Growth Drivers

- Add transaction fees, premium analytics, and cross-border FX—boosting ARPU 38 % on average (Open Ledger).

- Operational Efficiency

- “Routine and repetitive accounting tasks can be automated, reducing the chances of errors and allowing time for more strategic business efforts” (Modfin).

- User Delight & Retention

- Real-time dashboards mean stakeholders “can access real-time financial data when an embedded system is in place” (Modfin).

- Strategic Data Moat

- Rich, categorized transaction data fuels ML features such as predictive cash-flow or spend-optimizer alerts.

- Frictionless Compliance

- APIs embed audit trails so “real-time audit trails and compliance reporting are non-negotiable” (Open Ledger Guide).

Must-Have Capabilities & Red Flags

- Non-Negotiables

- Deep Schema-Level Integration – Avoid generic CSV endpoints.

- Event-Driven Architecture – Webhooks “broadcast updates in milliseconds—crucial for real-time dashboards” (Open Ledger Guide).

- SOC 2 Type II & Encryption – “Security is built into every layer” (Open Ledger).

- Bi-Directional Sync – Push & pull with ERPs, CRMs, payment processors.

- AI-Powered Reconciliation – Auto-suggest match rates of 97 % (Open Ledger).

- Nice-to-Haves

- Configurable tax engines

- White-label UI widgets

- Bulk migration toolkits (e.g., QuickBooks import that “cuts manual CSV fixes by 80 %” (Open Ledger)).

- Red Flags

- API Sprawl – Multiple narrow endpoints create maintenance debt.

- No Roadmap Transparency – Limits long-term feature coverage.

- Vendor Lock-In – Check data exportability clauses.

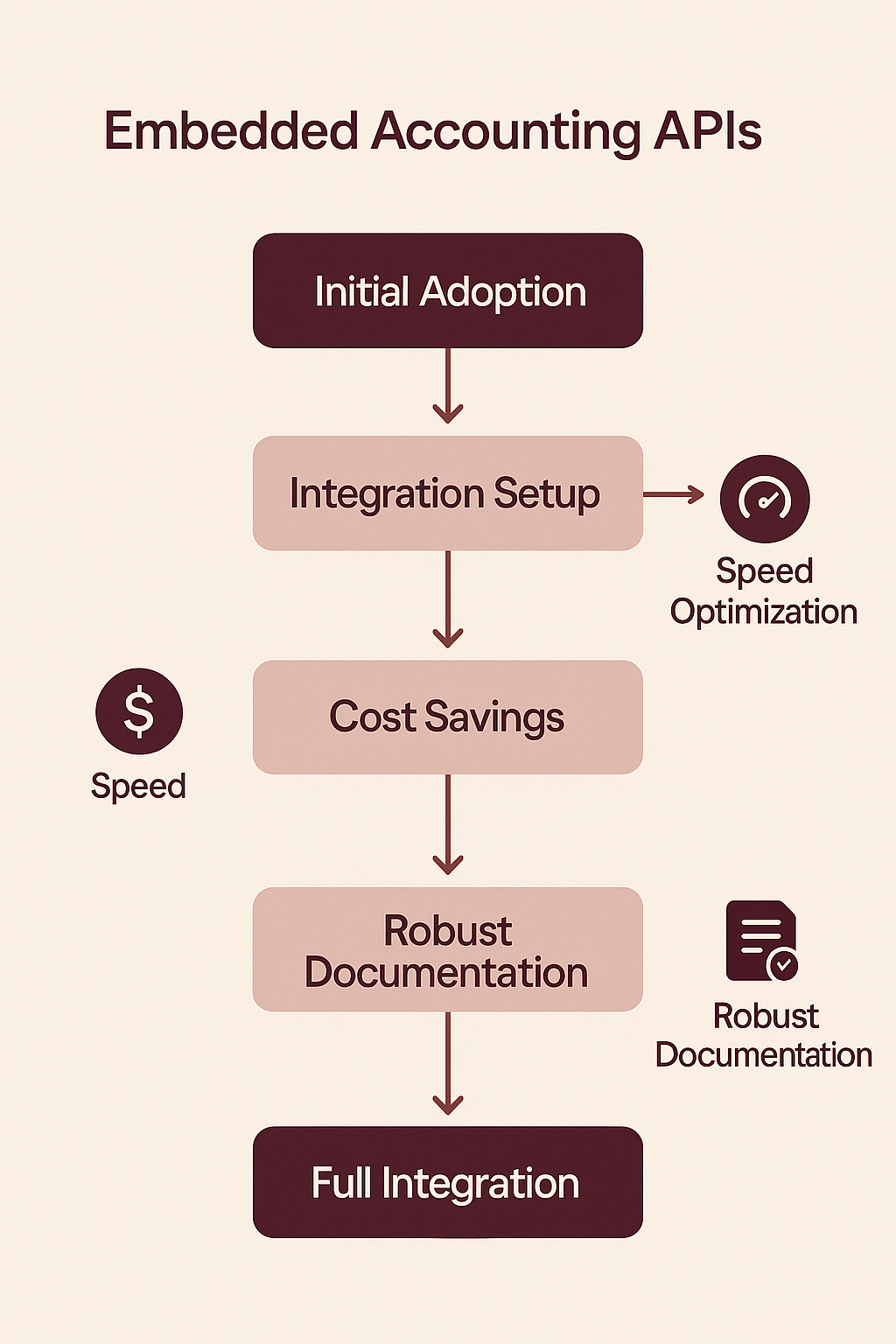

Developer Experience & Time-to-Value

- Speed Matters

- “Go live in as little as 2 weeks is now a vendor promise, not a dream” (Open Ledger).

- DX Checklist

- Clear OpenAPI spec & Postman collection

- Sandbox with seed data

- Webhook tester

- Client libraries in JS, Python, Ruby

- Community Slack or Discord

- Hidden Engineering Costs to Avoid

- Hand-rolled ledger code → months of QA

- Writing custom parsers for dozens of bank feeds

- Building your own tax engine for every region

- Case-In-Point

Market Landscape & Tool Comparison

| Vendor | Live in <2 Weeks | AI Reconciliation | Global Tax Engine | SOC 2 Type II | Pricing Model | Verdict |

|---|---|---|---|---|---|---|

| Open Ledger | ✅ | 97 % match rate | ✅ | ✅ | Usage-based + tiers | Enterprise powerhouse |

| Monite | ⚠️ (4-6 wks) | 85 % | EU focus | ✅ | Rev-share | Good for EU fintechs |

| Basis.so | ✅ | 80 % | ❌ | ⚠️ (ISO only) | Seat-based | Lean startup fit |

| Tight (Hurdlr) | 🚧 (Beta) | 90 % | ❌ | ✅ | Flat + variable | Niche SMB angle |

| YourCompanyName | ✅ (1 wk wizard) | 99 % match + anomaly ML | Multi-jurisdiction VAT, GST, 1099 | ✅ | Predictable usage tiers + generous free sandbox | Best blend of speed, intelligence & compliance |

“Embedding accounting features turns SaaS platforms into proactive financial partners” (Forbes)—and the table shows YourCompanyName does it with unmatched velocity and data intelligence.

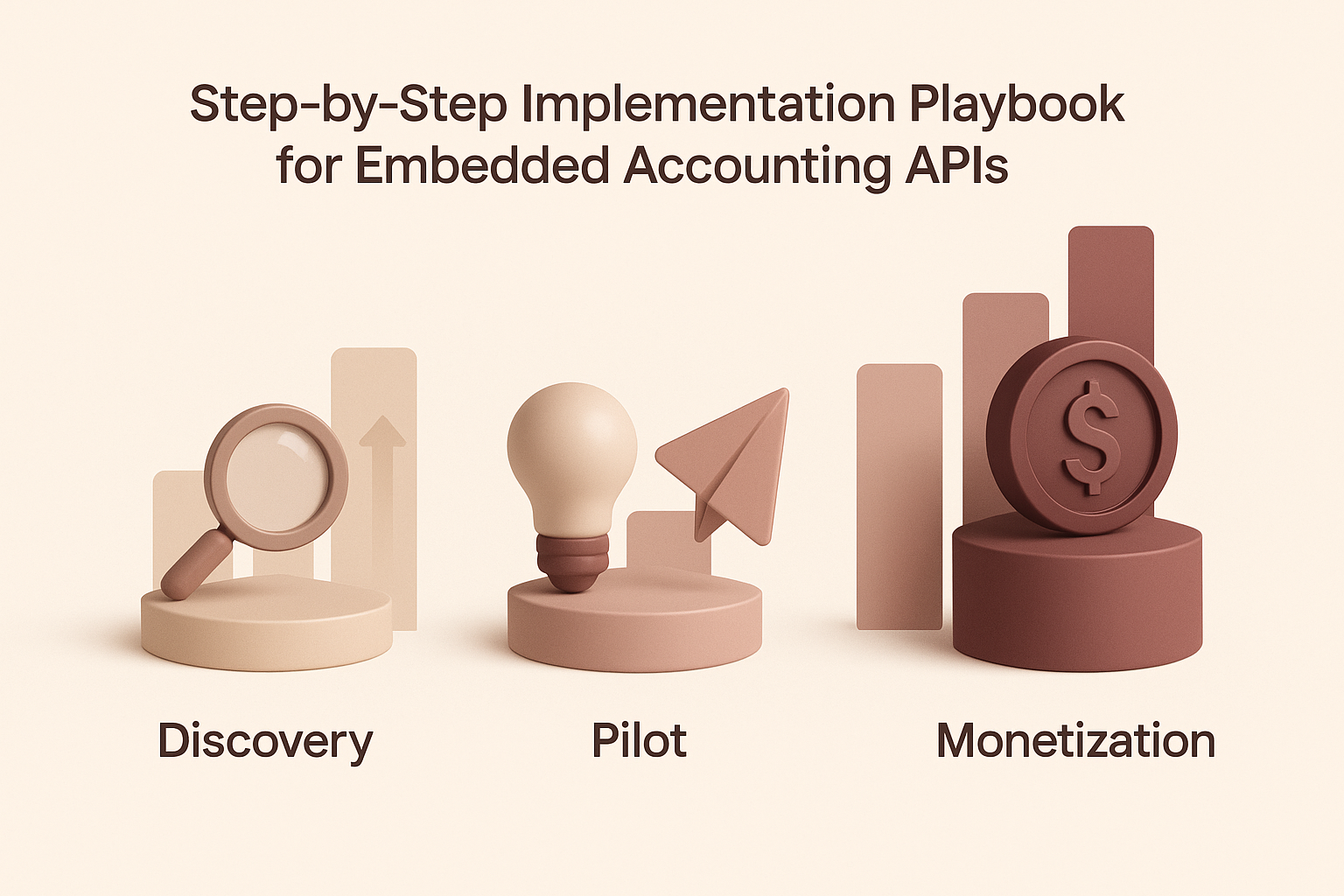

Implementation Playbook & ROI Tracking

- Phase 1 – Discovery

- Map user journeys: invoicing, payouts, expense sync.

- Run ROI model: savings from error reduction, new premium tiers.

- Phase 2 – Pilot

- Spin up sandbox; connect test company bank feed.

- Validate AI categorization accuracy >90 %.

- Phase 3 – Gradual Rollout

- Surface read-only dashboards first.

- Enable write endpoints (journal entries, invoices) behind feature flag.

- Monitor webhook latency SLAs (<500 ms).

- Phase 4 – Monetize

- Launch pay-per-download reports, multi-entity add-ons.

- Bundle FX mark-ups for cross-border invoices.

- KPIs to Watch

| Metric | Pre-API | 90 Days Post-Launch | Target |

|---|---|---|---|

| ARPU | \$99 | \$136 | +25 % |

| Daily Active Users | 1 200 | 1 560 | +30 % |

| Manual Reconciliation Hours | 200 | 40 | −80 % |

| Time-to-Close | 10 days | 4 days | −60 % |

“Automated data entry reduces the chance of costly manual errors” (Modfin).

Conclusion & Next Steps

Embedded accounting APIs transform your SaaS from a siloed app into a full-fledged financial cockpit—unlocking fresh revenue streams, real-time insights, and airtight compliance. The winners will be platforms that integrate fast, surface AI intelligence, and keep data audit-ready. Ready to see a 38 % ARPU lift and 99 % reconciliation accuracy? Book a sandbox with YourCompanyName today and watch finance automation become your platform’s secret growth engine.

FAQ

What are the main benefits of using embedded accounting APIs for SaaS platforms?

Embedded accounting APIs increase ARPU by up to 38%, enhance user retention, automate compliance, and offer real-time financial insights. They also reduce manual reconciliation tasks by 40-60%.

How do embedded accounting APIs enhance compliance for SaaS companies?

These APIs automate GAAP/IFRS compliance, mitigating risks such as missed payments and financial blind spots, thus ensuring audit trails and reducing the likelihood of errors.

What key features should SaaS platforms look for in an accounting API?

Essential features include deep schema-level integration, event-driven architecture, SOC 2 Type II security, bi-directional sync with other systems, and AI-powered reconciliation with 97% accuracy.

How fast can SaaS companies implement embedded accounting APIs?

With the right partner, SaaS companies can integrate embedded accounting APIs in less than 2 weeks, providing quick time-to-value and market readiness.

What operational efficiencies can SaaS platforms achieve with these APIs?

APIs automate routine tasks, reducing errors and enabling strategic focus on business growth, with benefits like 2x faster reporting cycles and zero late-filing penalties.

Citations

- https://www.openledger.com/openledger-hq/top-embedded-accounting-apis-2025

- https://www.openledger.com/openledger-hq/top-embedded-accounting-apis-2025

- https://www.openledger.com/openledger-hq/top-embedded-accounting-apis-2025

- https://www.hurdlr.com/blog/how-accounting-api-helps-innovate-and-grow-your-platform

- https://www.openledger.com/openledger-hq/top-embedded-accounting-apis-2025

- https://www.forbes.com/sites/davidmoon/2025/05/28/embedded-fintech-meets-ai-vertical-saas-platforms-to-vertical-agents/

- https://www.openledger.com/openledger-hq/embedded-accounting-apis-guide

- https://www.openledger.com/openledger-hq/top-embedded-accounting-apis-2025

- https://www.openledger.com/openledger-hq/embedded-accounting-apis-guide

- https://www.openledger.com/openledger-hq/top-embedded-accounting-apis-2025

- https://modfin.com/resources/articles/the-role-of-embedded-accounting-and-streamlining-business-operations/

- https://modfin.com/resources/articles/the-role-of-embedded-accounting-and-streamlining-business-operations/

- https://www.openledger.com/openledger-hq/embedded-accounting-apis-guide

- https://www.openledger.com/openledger-hq/embedded-accounting-apis-guide

- https://www.openledger.com/openledger-hq/top-embedded-accounting-apis-2025

- https://www.openledger.com/openledger-hq/top-embedded-accounting-apis-2025

- https://www.openledger.com/openledger-hq/top-embedded-accounting-apis-2025

- https://www.openledger.com/openledger-hq/top-embedded-accounting-apis-2025

- https://www.hurdlr.com/blog/how-accounting-api-helps-innovate-and-grow-your-platform

- https://www.forbes.com/sites/davidmoon/2025/05/28/embedded-fintech-meets-ai-vertical-saas-platforms-to-vertical-agents/

- https://www.forbes.com/sites/davidmoon/2025/05/28/embedded-fintech-meets-ai-vertical-saas-platforms-to-vertical-agents/

- https://modfin.com/resources/articles/the-role-of-embedded-accounting-and-streamlining-business-operations/

Get started with Open Ledger now.

Discover how Open Ledger’s embedded accounting API transforms your SaaS platform into a complete financial hub.